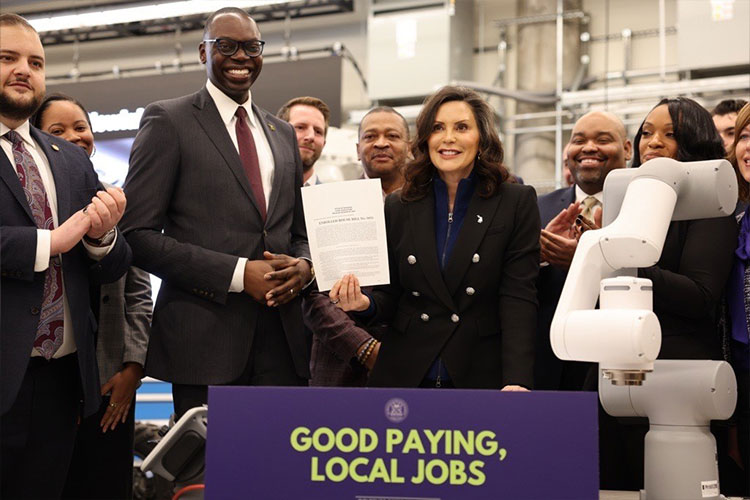

Governor Whitmer Signs Bipartisan Bills Establishing Innovation Fund, R&D Tax Credit to Unleash Entrepreneurship, Lower Costs for Businesses, Create Jobs

Governor's Office

Monday, January 13, 2025

Each of these bills invests in our state’s economy and workforce, ensuring Michigan is a leader in technology and innovation

LANSING, Mich. – Today, Governor Gretchen Whitmer signed five bipartisan bills to establish the Michigan Innovation Fund and an R&D Tax Credit. These new tools will lower costs for businesses, support innovators and entrepreneurs, and create and support good-paying jobs by ensuring businesses of all sizes have the tools and resources they need to reinvest in Michigan. The bills also attract investments in our state by incentivizing research and innovation, growing Michigan’s economy, and creating thousands of jobs in counties across our state. Including today’s legislation, Governor Whitmer has signed a record 1,436 bipartisan bills into law since taking office.

“Our brand-new, bipartisan Innovation Fund and R&D Tax Credit will empower Michigan entrepreneurs, lower costs for Michigan businesses, and create good-paying Michigan jobs,” said Governor Whitmer. “I’m proud that we worked across the aisle on these commonsense bills to grow our economy and ensure more people can make it in Michigan. We still have more work to do to make Michigan the best state to build your big idea, and I’ll have more to say later this week during my Road Ahead Address.”

“Throughout our history, Michigan minds and muscle have pushed boundaries, made a difference, and driven our state forward,” said Lt. Governor Garlin Gilchrist II. “These new tools will make it easier for countless innovators and entrepreneurs across Michigan to grow our economy, pioneer exciting tech, and make their next big idea a reality. Let us continue to stand tall, tell Michigan’s story, and show the world that Michigan is the best place to build the future.”

“I’m thrilled to start 2025 off strong by celebrating this historic new investment in Michigan’s innovation economy,” said Ben Marchionna, Chief Innovation Ecosystem Officer at the MEDC. “By establishing the Michigan Innovation Fund alongside the new R&D Tax Credit, we’re declaring the grit, creativity, and enduring prowess of our entrepreneurs and innovators deserve to be supported and showcased. Equitable, accessible funding and an R&D-friendly tax environment is how we’ll transform today’s big ideas into tomorrow’s growth industries. I’m grateful to the legislature, Governor Whitmer and Lt. Governor Gilchrist for supporting this as the largest state appropriation for entrepreneurship and innovation in nearly two decades. This bold move shows the world that Michigan is serious about building a thriving innovation ecosystem – one where founders can truly ‘Make it’ in Michigan.”

House Bills 5100 and 5101, sponsored by state Representatives Jasper Martus (D-Flushing) and Julie Rogers (D-Kalamazoo), supports economic development and innovation within Michigan by establishing a Research and Development (R&D) tax credit for eligible taxpayers and employers. Taxpayers and authorized businesses with 250 or more employees could claim up to $2 million per taxpayer or business, respectively, per year. Companies with fewer than 250 employers can claim up to $250,000 per taxpayer or business, respectively, per year. The credit also allows taxpayers or employers to claim up to $200,000 in an additional credit for expenses if they collaborate with a research university. These bills will help leverage our universities, making Michigan a hub for innovation and providing a vital boost to local economies across the state. This change will join Michigan with 36 other states who already have an R&D tax credit, helping make our state a frontrunner in innovation by incentivizing more companies to invest in the state and attracting employees looking for high-paying jobs in these industries.

“I am thrilled to see these bipartisan bills signed into law. This legislation aligns Michigan with over 30 states already benefiting from research and development tax credits, which strengthen their economies,” said state Representative Julie Rogers (D-Kalamazoo). “My bill aims to add robust incentives to increase and attract small businesses with fewer than 250 employees and fosters an environment to drive innovation and economic growth amongst many sectors, including life sciences and advanced manufacturing, ensuring our state feels positive economic impacts for generations to come.”

“I am truly ecstatic that the governor has signed this package of bills into law,” said state Representative Jasper R. Martus (D-Flushing). “First and foremost, it is important that Michigan continues to encourage innovation and productive economic development in our state. This bill package will help continue to build our state’s reputation for being ‘the place’ to start and develop a business — which then uplifts people, job opportunities and bolsters our economy.”

“Innovation is the key to growth for manufacturing, the state’s largest and most critical sector,” said Mike Johnston, Executive Vice President for Government Affairs and Workforce Development, Michigan Manufacturers Association. “The creation of a research and development credit increases our competitiveness and will attract new jobs and investment opportunities to Michigan.”

“The enactment of a new Michigan R&D tax credit is a tremendous victory for the state’s life sciences and other high-tech industries that will spur company formation and economic growth,” said Dr. Stephen Rapundalo, President and CEO of MichBio. “This reestablishment, especially with its dedicated fund for early-stage ventures and an added premium for research university collaborations, is a huge step towards raising Michigan’s overall level of competitiveness in the life sciences and helping to incentivize development of the next generation of medical breakthroughs and products while creating high-wage jobs.”

House Bills 5651, 5652, and 5653, sponsored by state Representatives Greg VanWoerkom (R- Norton Shores), Jason Hoskins (D-Southfield), and Alabas Farhat (D-Dearborn), support Michigan businesses and help attract potential investments to our state by establishing a Michigan Innovation Fund Program, allocating $60 million to fuel Michigan innovation. Currently, entrepreneurs and business startups face difficulties in Michigan due to a lack of early-stage capital. These bills align Michigan with our Midwest neighbors by creating an innovation fund that provides financial support for entrepreneurs and companies. Not only will existing businesses be able to thrive, but companies will be incentivized to locate to our state, expanding Michigan’s talent pool and fostering innovation and economic development across our communities.

“With this bill becoming law, we’re creating a cycle of opportunity that will generate good paying jobs and elevate Michiganders. We are creating stronger entrepreneurs and building up a foundation for local businesses,” said state Representative Jason Hoskins (D-Southfield). “Today, we ensured that Michigan remains a place where great ideas can thrive. The Michigan Innovation Fund will provide direct support to startups and job creators here at home.”

“I am proud to see the Michigan Innovation Fund cross the finish line, paving a better road forward for our state’s business startups to thrive,” said state Representative Alabas Farhat (D-Dearborn). “This legislation will uplift small businesses across the state, creating more jobs and more family-supporting paychecks for workers. Michigan has an immense amount of homegrown entrepreneurial talent — we’re tapping into that resource to move our economy forward and keep establishing Michigan as a hub for innovation.”

“I truly believe the next great business is here in Michigan, and the Michigan Innovation Fund will play a vital role in advancing our state’s economic ecosystem and helping our entrepreneurs thrive,” said state Representative Greg VanWoerkom (R-Norton Shores).

"We're so grateful for the vision and leadership shown by Governor Whitmer and the members of the Michigan legislature in creating the Michigan Innovation Fund," said Santa J. Ono, President of the University of Michigan. "U-M is proudly a leader in research and innovation, but we can do so much more. Through this support, we will foster new collaborations between researchers and businesses, accelerating discovery and innovation, and driving economic growth and job creation like never before."

“The Michigan Innovation Fund is a step to attract high-tech entrepreneurs and grow our economy and population – consistent with the Governor’s Grow Michigan Together Council report of 2024,” said Sandy K. Baruah, President and Chief Executive Officer of the Detroit Regional Chamber.

“Michigan was built by high flying entrepreneurs, and the Fund will be a valuable tool as we build our next generation of groundbreaking companies.”

“This investment in Michigan’s innovation economy would not have been possible without the support of leaders like Governor Whitmer, Lt. Governor Gilchrist, Representatives Alabas Farhat, Jason Hoskins, Greg VanWoerkom, and our coalition partners,” said Dave Blaszkiewicz, President and CEO of Invest Detroit. “As home to ID Ventures, one of the five evergreen funds supported by this program, Invest Detroit is proud to contribute to this effort. The Michigan Innovation Fund is a vital step in strengthening our start-up ecosystem, empowering entrepreneurs, and positioning Michigan as a leader in innovation and economic growth. This fund proves Michigan’s commitment to competing globally as a hub for talent and innovation and demonstrates what is possible when we unite around a shared vision for our future.”

“The Michigan Innovation Fund will bring historic support to Michigan’s startup economy, including northwest Michigan’s nationally-recognized startup and entrepreneurial community,” said Warren Call, president and CEO of Traverse Connect. “Innovative startups in Michigan are developing scalable businesses that will thrive and grow thanks to this important investment.”

About Michigan Economic Development Corporation (MEDC)

The Michigan Economic Development Corporation is the state’s marketing arm and lead advocate for business development, job awareness and community development with the focus on growing Michigan’s economy. For more information on the MEDC and our initiatives, visit www.MichiganBusiness.org. For Pure Michigan® tourism information, your trip begins at www.michigan.org. Join the conversation on: Facebook Instagram LinkedIn, and Twitter.

Recent Press Releases